Trump’s Tariffs:

Penguins, Trade Wars, and a Risky Bet on America’s Future

Unpacking Trump’s Tariff Strategy and Its Global Impact

Far off in the southern Indian Ocean lies Heard Island and McDonald Islands, an Australian territory untouched by human presence, where only penguins roam its frozen shores. Astonishingly, the Trump administration has placed a 10 percent tariff on this desolate enclave. It’s a striking example of a tariff policy reaching into the most unlikely places, prompting a deeper look at its scope and intent.

This oddity is just the tip of the iceberg in Trump’s tariff strategy—a policy that’s raising eyebrows, crunching numbers, and sparking debates from Jerusalem to Washington. I’ve written a lot about this, and here’s the full scoop: Trump’s tariffs, billed as “reciprocal,” aim to level the playing field and bring manufacturing back to America. I desperately want him to succeed—his presidency’s success could shape the world’s future—but I’m worried. Tariffs as the main economic plan might backfire, and if the economy tanks, we’re all in trouble. Let’s dive into the details.

Israel, Population, and the Limits of “Buying More”

Take Israel, a nation of 9 million, dwarfed by the U.S.’s 330 million-plus. Even if global trade deficits magically balanced, Israel could never buy as much from the U.S. as the U.S. buys from Israel. It’s not policy—it’s math. Americans, with their larger population and stronger buying power, snap up Israeli tech, agriculture, and defense products at a volume Israel’s smaller market can’t match with U.S. goods. So when Trump’s tariffs hit to “correct” this imbalance, Israel’s in a bind. “Buy more” sounds nice, but with a consumer base that small, it’s not feasible. Tariffs here don’t fix deficits—they just squeeze a partner already maxed out.

The Reciprocal Tariff Mirage

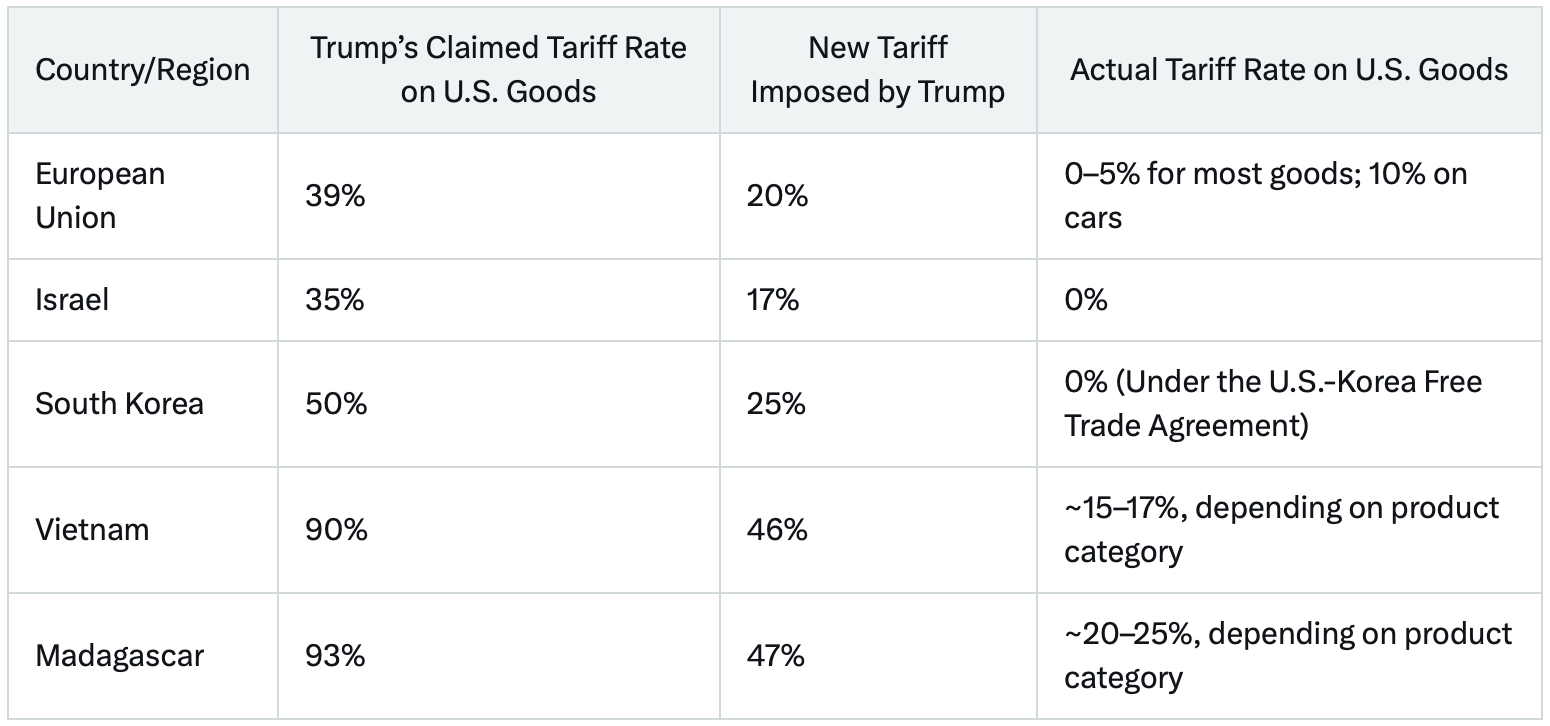

Trump’s tariffs aren’t truly reciprocal—they don’t mirror what other countries charge us. Instead, they’re cooked up from a formula: a country’s trade surplus with the U.S., divided by its exports to us, then halved. It’s arbitrary, not reflective of real tariff rates. Look at the numbers:

South Korea, a free trade partner with zero tariffs on most U.S. goods, gets hit with 25%. The EU, averaging 0-5%, faces 20%. These aren’t reciprocal—they’re punitive, based on deficits, not tariffs. A viral chart touting figures like Taiwan’s “64%” or Madagascar’s “93%”? Bogus. As Ben Shapiro pointed out, those are deficits divided by imports, not tariff rates. It’s misleading math dressed up as policy.

Shapiro’s Reality Check

Speaking of Shapiro, his latest show sliced through economic myths with surgical precision. He debunked the “failing economy” narrative: smartphones, computers, and fast delivery weren’t around in the ‘80s—today, they’re standard. That’s progress, not decline. On “de-industrialization,” he’s blunt: U.S. manufacturing output jumped from $1.4 trillion in 1997 to $2.4 trillion by 2025. Jobs dropped? Sure, but automation’s the culprit, not trade. The middle class? Stable, with 16% more climbing to upper-middle since 1980. And trade deficits? Not the boogeyman they’re made out to be—Shapiro cites the Great Depression, when a surplus didn’t save us. His data-driven clarity is tough to argue with.

Why Deficits Aren’t the Enemy

Trade deficits—when imports outpace exports—don’t mean we’re losing. They signal strength: a stable, innovative U.S. economy draws foreign investment. Countries like South Korea reinvest export earnings into U.S. stocks, bonds, and real estate, fueling jobs and funding debt. Consumers win too—cheap Vietnamese textiles and Korean electronics boost living standards. It’s comparative advantage at work, not exploitation. Obsessing over deficits, as economists note, distracts from real priorities like productivity and innovation.

The Tariff Trap

So why base tariffs on deficits? Trump’s formula ignores actual barriers, producing inflated, inconsistent rates. It’s a tax on imports, jacking up costs for U.S. businesses and consumers. Targeting surplus-heavy nations like China or Vietnam could spark trade wars, shrinking global growth. Worse, it might benefit China—the EU, South Korea, and others could pivot to Beijing, strengthening its hand as the world’s #2 economy. No one wins trade wars, as Thomas Sowell warned: “If you set off a worldwide trade war, that has a devastating history. Everybody loses.”

Manufacturing: Automation, Not Tariffs

Trump seems to want everything made in America—or at least, that’s the vibe. But manufacturing jobs didn’t vanish because of trade—they fell from 2000-2020 due to automation and robotics, even as output rose. Tariffs won’t reverse that; technology will keep humming along. Autarky—total self-reliance—isn’t smart either. Global supply chains drive efficiency, not isolation.

The Stakes Are High

I love Trump and want him to succeed in every way. His presidency rides on the economy—his key mandate. If he can’t deliver, Democrats could sweep in by 2028 with a socialist platform, blaming capitalism for the fallout. That could mean less U.S. support for allies like Israel, where some Dems already waver. A tanking economy drags everything down. Tariffs as a consumer tax won’t enrich America—they’ll strain it. But if he’s using them as a negotiation tactic, clearly stating demands, I’m all for it. That’s strategic, not scattershot.

A Better Way Forward

“Liberation Day” sounds great, but why fixate on deficits? They’ve coexisted with decades of U.S. growth, offset by foreign investment and the dollar’s reserve status. Tariffs should be a bargaining chip—pressure for lower barriers abroad—not a blunt tool to “fix” trade. Sowell’s right: history shows trade wars ruin everyone. I hope Trump proves me wrong and pulls this off—I’d love nothing more. But if the economy falters, the penguins won’t be the only ones in a bind. We need him to succeed, not just for America, but for the world.